BDO Suriname Tax News Alert

Content:

• Tripartite Agreement

• Tax adjustments as of January 1, 2022

Generally, our newsletter provides updates of developments on tax, legal and financial matters that might impact your business in Suriname. In this newsletter we provide an update of the latest tax developments. Please note that this newsletter contains general information and has been written in general terms and should therefore be used for general guidance purposes only.

The Government, Trade Unions and the business community have reached a Tripartite Agreement. With respect to taxes, which is an important pillar, we inform you about the upcoming changes. The Tripartite Agreement was reached after a joint effort and entails the cooperation and endorsement of the social partners in order to stabilize the socio-economic situation in the country. Based on the agreement reached by the Social Partners the following adjustments will apply per January 1, 2022: Regarding the payroll/Wage Tax: I. Increase of the monthly tax-free sum from SRD 220.50 to SRD 4,000. II. Increase of the tax-free annual threshold for the vacation allowance from SRD 4,000 to SRD 6,516. III. Increase of the tax-free annual threshold for the bonus from SRD 4,000 to SRD 6,516.

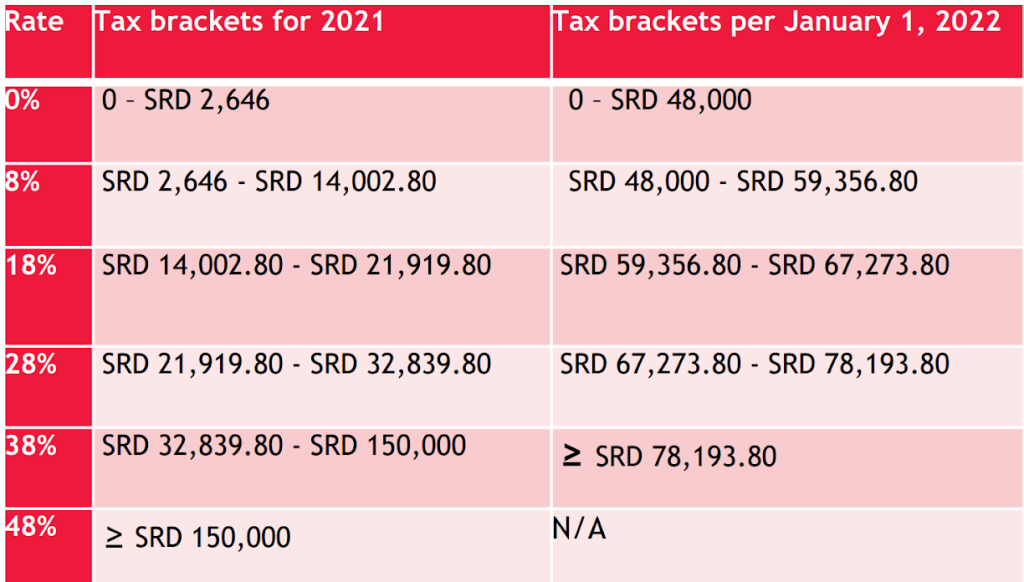

IV. The Tax brackets per year for the payroll will be adjusted as follows:

V. The levy rebate of SRD 750 per month will be included in the taxfree amount and will therefore expire.

VI. The fixed deduction per month for professional expenses remains maximized to SRD 100. As a result, due to the increase of the taxfree amount of SRD 4,000, the total tax-free amount per month will be SRD 4,100.

VII. Per July 2022, more structural changes of the tax brackets and Wage Tax will be implemented together with the introduction of the Value Added Tax (VAT).

BDO Tax Advisory N.V., a Suriname limited liability company, is a member of BDO International, a worldwide network of public accounting firms, called BDO Member Firms. Each BDO Member Firm is an independent legal entity in its own country. The network is coordinated by BDO Global Coordination B.V., incorporated in The Netherlands, with its statutory seat in Eindhoven (trade register registration number 33205251) and with an office at Boulevard de la Weluwe 60, 1200 Brussels, Belgium, where the International Executive Office is located. BDO is the brand name for the BDO network and for each of the BDO Member Firms.

For further information on the tax issues in this newsletter and possible impact on your organization, please contact one of our Suriname Tax Specialists:

Ilana.Goedschalk@bdo.sr

Dionne.Alexander@bdo.sr

For legal issues please contact: Ilana.Goedschalk@bdo.sr

General contact details:

Address: Grote Combéweg 37 Paramaribo, Suriname S.A.

Tel.: +597-427520 Fax: +597-427521

E-mail: info@bdo.sr

Website: www.bdo.sr

This publication has been carefully prepared, but it has been written in general terms and should be seen as broad guidance only. The publication cannot be relied upon to cover specific situations and you should not act, or refrain from acting, upon the information contained therein without obtaining specific professional advice. Please contact BDO to discuss these matters in the context of your particular circumstances. BDO, its partners, employees and agents do not accept or assume any liability or duty of care for any loss arising from any action taken or not taken by anyone in reliance on the information in this publication or for any decision based on it.

Source: BDO